Manage your payroll in an automated and confident way with

Gold Payroll

Gold Payroll is an easy-to-use payroll system with a vast array of features. Whether your dealership runs payroll for 5 employees or 5,000, Gold Payroll gets the important details right - every time.

Payroll automation.

Host expenses and benefits managed in one place, and payslips can be emailed directly to your employees.

Highly intuitive browser based interface that can be securely accessed from anywhere.

No need to install updates, carry out backups or worry about reliability.

Simplify payroll with an HMRC compliant payroll software.

Auto-enrolment allows you to save time and reduce costs.

What our customers say

User-Friendly and Comprehensive

"We have been using what we call “new” Gold pay roll since January 2025. It is proving to be user-friendly and comprehensive, with a great deal of functionality. Navigating the different areas of the software is logical and simple. The reporting side enables us to produce a wide range of tailored analysis for ourselves and senior management. The Support Team at IBCOS have been exceptional and have been pivotal in the transition from old to new software.”

- Barbara Marston at Lister Wilder (Finance Department)

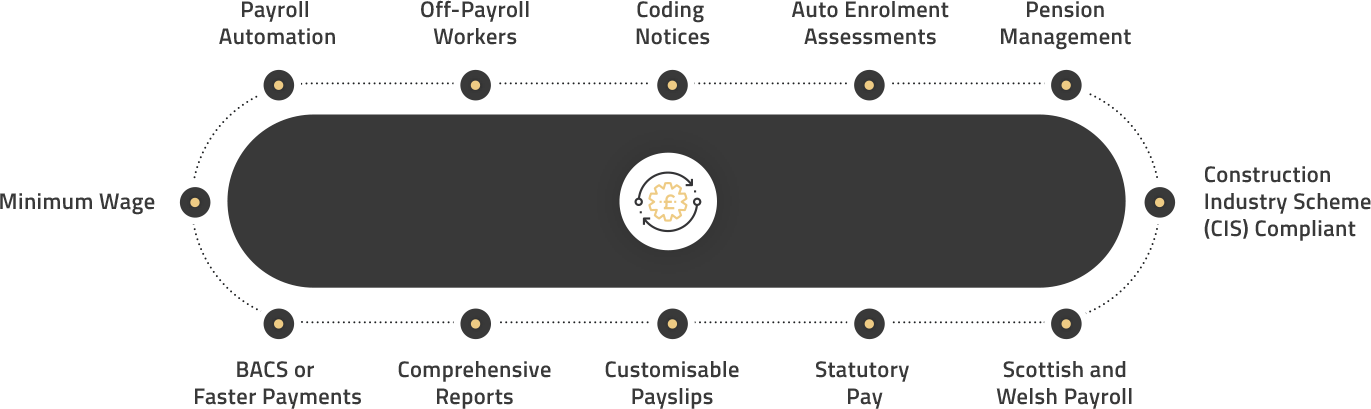

Some of the features include:

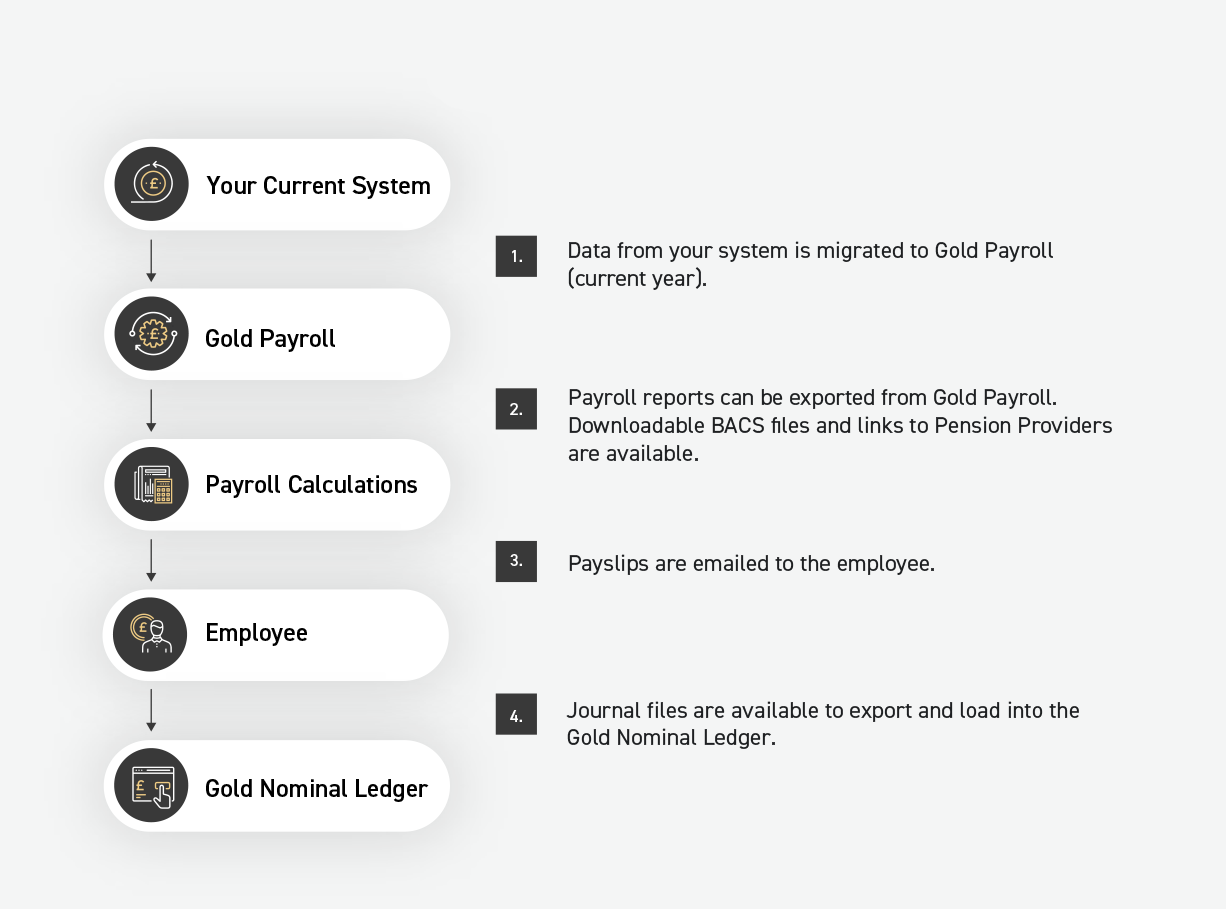

How does it work?

Resources

Gold Payroll

Here are some resources to help you get started with Gold Payroll.

Visit the Gold Payroll Help Centre for useful training material. If you'd like to suggest any user guides contact us at product_team@ibcos.co.uk.

Complete the checklist below or download and print your own copy here: Gold Payroll Post Migration Checklist

There are currently no updates that have been made to this product. If any bug fixes or enhancements are made, they will appear here.

Here is a list of frequently asked questions on Gold Payroll:

The URL for the Login page is: https://gold.payroll-app.com

Gold Payroll includes all the statutory and many other reports, views and exports to allow you to manage your payroll in the way you need to. Accessing reports within Gold Payroll is simple and intuitive. To see more on what reports are included and how they can be accessed have a look at the user help for reporting which can be found here.

Gold Payroll includes all the statutory and many other reports, views and exports to allow you to manage your payroll in the way you need to. Accessing reports within Gold Payroll is simple and intuitive. To see more on what reports are included and how they can be accessed have a look at the user help for reporting which can be found here.

PAPDIS (Payroll and Pension Data Interface Standard) is an open standard that allows for transfers of data between pension providers and payroll software. Gold Payroll is PAPDIS-ready, making it easy to integrate with any eligible pension provider, giving you more flexibility, more control and more choice. Automatic links are available with Nest, Smart Pension Employer, Smart Pension Adviser, The People’s Pension. But you can also manually add a pension provider such as Scottish Widows, PensionBee, Hargreaves Lansdown, Money Farm, Wealthify.

Absolutely! As the new system is entirely browser based and securely accessed over the internet this will be possible.

It is not mandatory to use but if you chose not to use it, you'd need to ensure that you’ve accounted for leave correctly and that the amount paid includes holiday.

Yes!

Yes, Gold Payroll includes integration with Banks for payments which should prevent the need for the downloaded report.

To achieve this you can create two companies, one for each frequency of pay, and assign different users to each. They can have the same HMRC details and managing the submissions is all possible within Gold Payroll.

Yes - a rolling year process is a standard function available within Gold Payroll.

Yes - the migration process that will be operated by the Ibcos team will copy across these data items. More detail on any data that won't come across or needs to be setup in a certain way to come across, will be shared soon.

Yes - the import process is the same within Ibcos Gold but the export process from Gold Payroll is different and allows more fine-grained detail and configuration.

Visit our Payroll Help Centre to find the answers to your question: Payroll Week 53, 54 or 56 - Payroll Help Centre

We have a relationship with a provider of HR software that includes functionality around holiday approvals and timesheets. This product fully integrates with Gold Payroll. If you are interested in this please discuss with your account manager.

We will be exploring options to integrate with Time Keeping systems using the API technology we have available. We will make available interfaces to Square, WeWorked, RotaCloud, Quinyx and Deputy.

Watch the recording of our Gold Payroll webinar that was held on October 18, 2024.

Still haven’t found what you’re looking for?

Fill in the form below and submit your question. A member of our team will get back to you shortly.